It can be a good idea to get insurance for your dog, especially if you are concerned about the costs of medical treatment for your pet. Dogs, like humans, can get sick or injured and may need medical attention, which can be expensive. Insurance can help cover the costs of vet visits, surgeries, and other treatments, which can give you peace of mind and financial protection.

There are many different types of pet insurance policies available, so it’s important to do your research and choose a policy that meets your needs and budget. Pet insurance can help cover the costs of vet visits, surgeries, and other treatments, giving you peace of mind and financial protection. But with so many different policies and companies to choose from, how do you know which one is the right one for you and your pet?

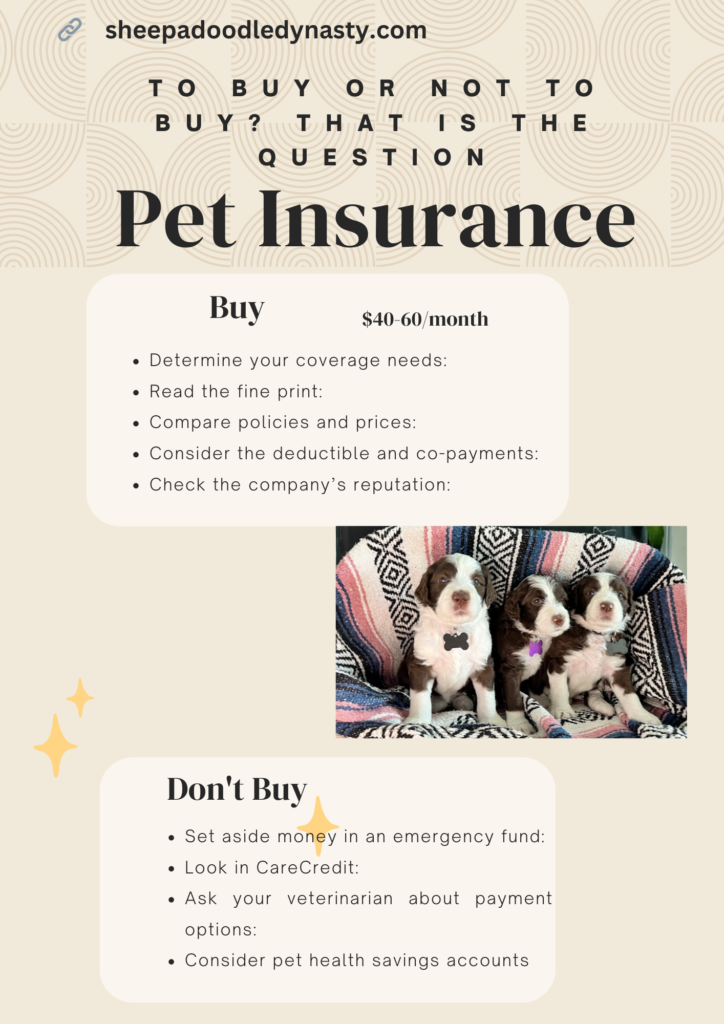

Here are some tips for choosing the right pet insurance:

- Determine your coverage needs: Consider what types of medical treatment your pet is most likely to need. For example, if your pet is prone to certain conditions or has a preexisting condition, you may want a policy that covers those specific treatments.

- Read the fine print: Make sure you understand what is covered and what isn’t covered under the policy. Some policies may have exclusions for certain conditions or treatments for certain conditions or treatment or may have limits on the amount of coverage.

- Compare policies and prices: Shop around and compare policies from different insurers to find the best one for you and your pet. Don’t just focus on price – consider the coverage options and exclusions as well.

- Consider the deductible and co-payments: A policy with a lower deductible (the amount you have to pay before the insurance company covers the rest) may have a higher premium (monthly cost), while a policy with a higher deductible may have a lower premium. Consider which option is best for your budget.

- Check the company’s reputation: Look for a reputable insurer with a good track record of paying out claims. Read reviews and ask for recommendations from other pet owners.

If you decide to not have pet insurance, there are still ways you can prepare for the possibility of unexpected medical costs for your pet.

Here are a few options to consider:

- Set aside money in an emergency fund: Consider setting aside a certain amount of money each month in separate savings accounts specifically for unexpected pet medical costs. This can help you pay for unexpected treatments without having to dip into your regular savings or go into debt.

- Look in CareCredit: CareCredit is a healthcare financing credit care that can be used for veterinary care. It offers low or no-interest financing options, but it’s important to read the terms and conditions carefully and make sure you can afford the monthly payments before using it.

- Ask your veterinarian about payment options: Some veterinarians may offer payment plans or accept credit cards for payment. It’s worth asking if this is an option if you are unable to pay for treatment upfront.

- Consider pet health savings accounts: These are similar to traditional health savings accounts for humans, but for pets. You can contribute pre-tax dollars to the account and use it to pay for qualifying medical expenses for your pet.

Ultimately, whether or not you decide to get insurance for your dog is a personal decision that depends on your individual circumstances and needs. If you are concerned about the potential costs of medicare for your pet, it may be worth considering pet insurance as a way to protect yourself financially.